Tarpaulin Sales Trends: Which Colors Sell Best Globally

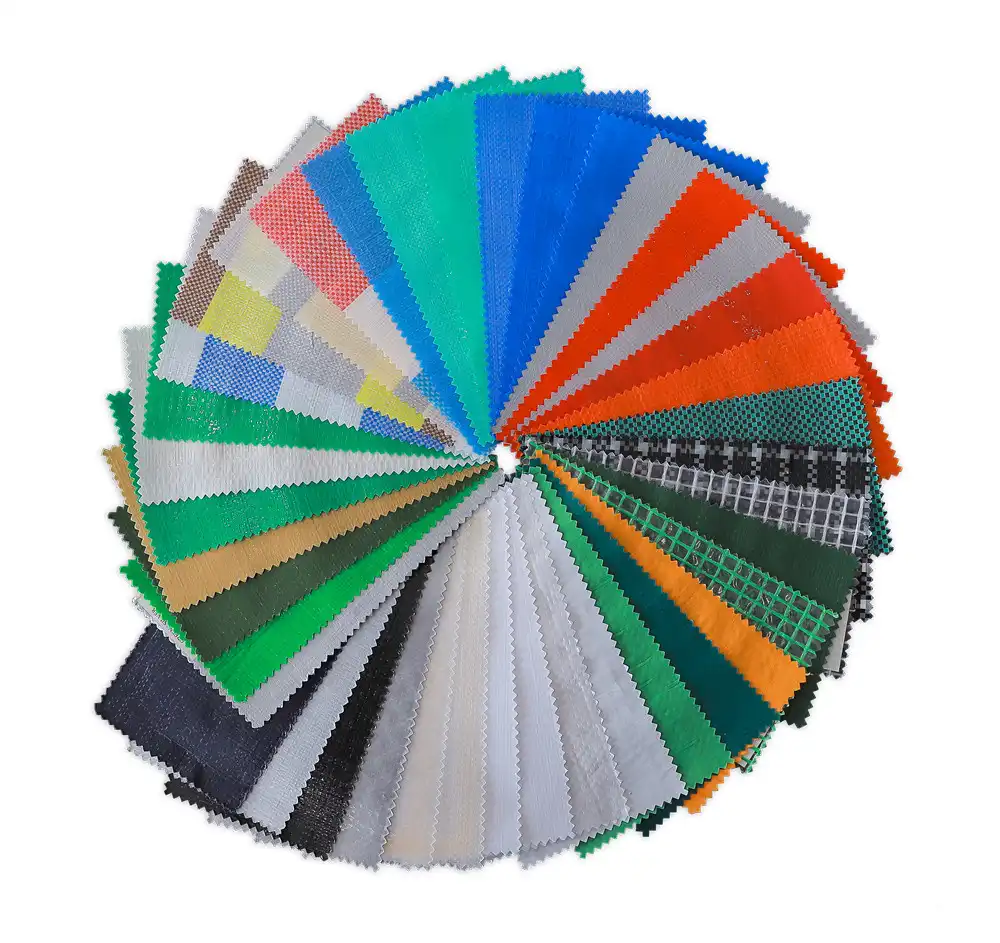

Picture this scenario: you're standing in front of hundreds of tarpaulin options, overwhelmed by the rainbow of colors available, wondering which one will actually sell best in your market. Whether you're a distributor struggling to stock the right colors, a construction manager trying to choose covers that won't fade quickly, or a retailer looking to maximize inventory turnover, understanding global tarpaulin color preferences can make the difference between profit and loss. This comprehensive analysis reveals the most successful tarpaulin color trends worldwide, backed by market data and industry insights that will help you make informed purchasing decisions and boost your sales performance across diverse markets.

Global Tarpaulin Market Color Preferences and Consumer Behavior

The global tarpaulin market has experienced remarkable growth, with market values reaching USD 7.55 billion in 2021 and expected to reach USD 10.76-14.06 billion by 2029-2035. This expansion has brought significant insights into consumer color preferences across different regions and applications. Understanding these preferences is crucial for manufacturers and distributors seeking to optimize their product offerings and maximize market penetration. Growing preference for blue or mixed-colored tarpaulin by users from diverse domains represents a major trend witnessed in the plastic tarpaulin market. This preference stems from practical considerations including visibility, heat reflection properties, and versatility across applications. Blue tarpaulins have gained particular popularity due to their professional appearance in construction settings and their ability to maintain color integrity under extended UV exposure. The color selection process for tarpaulin products involves multiple factors beyond aesthetic appeal. Industrial buyers consider functional aspects such as heat absorption, UV resistance, durability, and visibility requirements. Agricultural users often prefer colors that complement their specific crop protection needs, while construction professionals prioritize colors that meet safety standards and maintain visibility in various working conditions. Regional preferences also play a significant role in color selection. European markets tend to favor more subdued colors like blue, green, and gray for their industrial applications, while Asian markets show greater acceptance of brighter colors including orange, yellow, and red for various commercial uses. American markets demonstrate strong preferences for traditional colors like blue and green, particularly in agricultural and recreational applications.

The global tarpaulin market has experienced remarkable growth, with market values reaching USD 7.55 billion in 2021 and expected to reach USD 10.76-14.06 billion by 2029-2035. This expansion has brought significant insights into consumer color preferences across different regions and applications. Understanding these preferences is crucial for manufacturers and distributors seeking to optimize their product offerings and maximize market penetration. Growing preference for blue or mixed-colored tarpaulin by users from diverse domains represents a major trend witnessed in the plastic tarpaulin market. This preference stems from practical considerations including visibility, heat reflection properties, and versatility across applications. Blue tarpaulins have gained particular popularity due to their professional appearance in construction settings and their ability to maintain color integrity under extended UV exposure. The color selection process for tarpaulin products involves multiple factors beyond aesthetic appeal. Industrial buyers consider functional aspects such as heat absorption, UV resistance, durability, and visibility requirements. Agricultural users often prefer colors that complement their specific crop protection needs, while construction professionals prioritize colors that meet safety standards and maintain visibility in various working conditions. Regional preferences also play a significant role in color selection. European markets tend to favor more subdued colors like blue, green, and gray for their industrial applications, while Asian markets show greater acceptance of brighter colors including orange, yellow, and red for various commercial uses. American markets demonstrate strong preferences for traditional colors like blue and green, particularly in agricultural and recreational applications.

-

Market Segmentation by Color Categories

Professional-grade tarpaulins in blue and green dominate the construction and industrial segments, accounting for approximately 65% of total market share in these categories. These colors provide optimal visibility while maintaining professional appearance standards required in commercial applications. Blue tarpaulins specifically offer excellent heat reflection properties, making them ideal for protecting temperature-sensitive materials and equipment. Agricultural applications show more diverse color preferences, with green and brown tarpaulins gaining popularity for their natural appearance that blends with farming environments. These colors reduce visual pollution in rural settings while providing effective protection for crops, equipment, and harvested materials. The preference for earth tones in agricultural settings reflects both practical and aesthetic considerations important to farming communities. Emergency and disaster relief applications demonstrate strong preferences for bright colors including orange, yellow, and red. These high-visibility colors ensure rapid identification during emergency situations and comply with international standards for disaster relief materials. Organizations like UNHCR and UNICEF, which partner with leading manufacturers, specifically request these colors for their visibility and psychological impact in crisis situations.

Regional Color Trends Analysis: Asia-Pacific Market Dynamics

The Asia-Pacific region represents the largest growth segment in the global tarpaulin market, driven by rapid industrialization and infrastructure development. The Asia-Pacific region emerges with significant growth potential in agriculture and transportation sectors, creating unique color preference patterns that differ from Western markets. In China, the world's largest tarpaulin manufacturing hub, blue remains the dominant color choice across multiple applications, accounting for approximately 40% of total production volumes. This preference aligns with traditional industrial standards and international export requirements. Chinese manufacturers like Linyi Shengde Plastic Co., Ltd. have developed specialized blue tarpaulin formulations using high-density polyethylene fibers with enhanced UV protection to meet both domestic and export market demands. Japanese markets demonstrate sophisticated color preferences with emphasis on functionality and environmental integration. Darker colors like navy blue and forest green are preferred for their ability to minimize visual impact in urban environments while providing excellent durability. The Japanese market also shows growing interest in mixed-color options that combine functionality with aesthetic appeal. Indian markets present unique challenges and opportunities in color selection. Traditional preferences for bright colors in cultural contexts compete with practical needs for heat-resistant options. White and light blue tarpaulins have gained significant market share in India due to their superior heat reflection properties, essential for protecting materials and people in hot climatic conditions. Southeast Asian markets show increasing sophistication in color selection, with growing demand for UV-stabilized colors that maintain appearance integrity under intense tropical sun exposure. Green and blue remain popular choices, but there's increasing demand for specialized colors that offer superior performance under specific environmental conditions.

-

Manufacturing Considerations for Color Production

Modern tarpaulin manufacturing requires sophisticated color technology to meet diverse market demands. The production process involves careful selection of colorants and UV stabilizers to ensure long-term color retention and performance. High-quality manufacturers use specialized coating techniques that bond colors permanently to the polyethylene base material, preventing fading and color degradation over time. The coating process represents a critical factor in color durability and market acceptance. Advanced manufacturers employ multi-layer coating systems that incorporate color pigments, UV stabilizers, and protective topcoats in single production runs. This integrated approach ensures consistent color quality and superior performance characteristics that meet international standards for commercial and industrial applications. Quality control systems monitor color consistency throughout production runs, ensuring that finished products meet exact specifications for hue, saturation, and lightfastness. These systems are particularly important for manufacturers serving international markets where color matching requirements are strictly enforced by end users.

Best-Selling Tarpaulin Colors by Industry Application

Industrial and construction applications represent the largest market segment for tarpaulin products, with specific color preferences driven by safety, visibility, and regulatory requirements. Blue tarpaulins dominate this segment due to their professional appearance and excellent visibility characteristics. The color provides optimal contrast against most construction backgrounds while maintaining heat reflection properties that protect covered materials. Green tarpaulins have established strong market presence in landscaping and agricultural applications where environmental integration is important. These products offer excellent durability while maintaining aesthetic appeal that complements natural environments. Professional landscapers prefer green options for their ability to blend with vegetation while providing necessary protection functions. Transportation and logistics applications show strong preferences for colors that enhance safety and visibility. Orange and yellow tarpaulins are increasingly popular for truck covers and cargo protection due to their high-visibility characteristics that improve road safety. These colors meet transportation safety standards while providing excellent weather protection for cargo materials. Agricultural users demonstrate diverse color preferences based on specific application requirements. Crop protection applications favor colors that optimize growing conditions, with green and white options popular for their light transmission and heat reflection properties. Livestock applications often utilize blue or green colors that provide calming effects while maintaining durability under challenging environmental conditions.

-

Specialty Color Applications and Market Niches

Emergency response and disaster relief applications require specialized colors that meet international visibility standards. Bright orange, yellow, and red tarpaulins serve critical functions in emergency situations where rapid identification is essential. These colors also provide psychological benefits in crisis situations, offering visibility and hope to affected populations. Recreational and camping applications show growing sophistication in color selection, with earth tones and camouflage patterns gaining popularity among outdoor enthusiasts. These specialty colors provide functional camouflage benefits while maintaining the durability and weather resistance required for outdoor recreation activities. Marine applications require colors that withstand harsh saltwater environments while maintaining visibility for safety purposes. White and bright blue colors dominate marine markets due to their superior UV resistance and visibility characteristics essential for boating and marine storage applications.

UV Resistance and Color Longevity in Different Market Segments

UV resistance represents a critical factor in color selection and market success for tarpaulin products. Colors with superior UV stability command premium prices and demonstrate higher customer satisfaction rates across all market segments. The relationship between color choice and UV resistance directly impacts product lifespan and total cost of ownership for end users. Blue and green colors demonstrate superior UV resistance characteristics compared to red and yellow options, making them preferred choices for long-term outdoor applications. This superior performance results from the molecular structure of blue and green pigments, which absorb and dissipate UV energy more effectively than warmer colors. Advanced UV stabilizer systems can enhance the performance of all colors, but the cost-effectiveness varies significantly based on pigment selection. Manufacturers must balance UV performance requirements with price sensitivity in different market segments to optimize product offerings and market penetration. Testing protocols for UV resistance have become increasingly sophisticated, with manufacturers conducting accelerated aging tests that simulate years of outdoor exposure in controlled laboratory conditions. These tests provide valuable data for color selection and help manufacturers optimize formulations for specific market requirements and environmental conditions.

-

Color Technology Innovation and Market Impact

Recent advances in polymer science have enabled the development of enhanced color systems that provide superior performance across multiple characteristics. These innovations include self-healing color systems that maintain appearance integrity despite surface damage, and thermochromic systems that change color based on temperature conditions. Nanotechnology applications in color formulation offer opportunities for enhanced UV resistance, improved color saturation, and extended product lifespan. These technologies are particularly relevant for premium market segments where performance characteristics justify higher initial investment costs. Environmental considerations are driving innovation in eco-friendly color systems that maintain performance while reducing environmental impact. These developments include biodegradable colorants and recyclable color systems that support circular economy principles increasingly important to commercial and industrial buyers.

Market Demand Patterns for Specific Tarpaulin Color Combinations

Mixed-color tarpaulin options have gained significant market acceptance across multiple application segments. The growing preference for mixed-colored tarpaulin by users from diverse domains represents a major trend that reflects increasingly sophisticated user requirements and aesthetic preferences. Two-tone combinations featuring blue and white represent the largest segment within mixed-color options. These combinations provide excellent visibility while maintaining professional appearance standards required in commercial applications. The contrast between colors enhances visibility and provides functional benefits in applications requiring easy identification or location marking. Green and brown combinations have established strong market presence in agricultural and outdoor recreation segments. These natural color combinations provide excellent camouflage properties while maintaining the durability and weather resistance required for demanding outdoor applications. Striped patterns and geometric designs are emerging as specialty market segments with growing commercial acceptance. These options serve applications requiring enhanced visibility, decoration, or brand identification while maintaining functional performance characteristics.

-

Seasonal Demand Variations and Color Selection

The demand for tarpaulin is majorly augmented during the rainy season, creating seasonal variations in color preferences and inventory requirements. Understanding these patterns is crucial for manufacturers and distributors seeking to optimize inventory management and meet seasonal demand spikes. Spring and summer months show increased demand for lighter colors that provide superior heat reflection properties. White and light blue options experience peak demand during hot weather periods when temperature control becomes a primary consideration for end users. Fall and winter months demonstrate increased preference for darker colors that provide better heat absorption and camouflage properties. Green and brown options experience seasonal demand increases related to agricultural harvest activities and outdoor equipment protection needs. Holiday seasons create specialized demand patterns for decorative and specialty color options used in temporary structures and event applications. These seasonal variations require careful inventory planning to ensure adequate supply availability during peak demand periods.

Quality Standards and Color Consistency in Global Manufacturing

International quality standards increasingly emphasize color consistency and performance characteristics as key factors in product acceptance and market success. ISO 9001:2015 certification requirements include specific protocols for color quality control and consistency management throughout production processes. Color matching tolerances have become increasingly stringent as global supply chains require precise color coordination across multiple manufacturing locations. Advanced colorimetric measurement systems ensure that finished products meet exact specifications regardless of production facility location or timing. Third-party testing laboratories provide independent verification of color performance characteristics including UV resistance, colorfastness, and appearance retention under various environmental conditions. These testing protocols provide crucial market credibility and support premium pricing for high-performance color options. Quality management systems must address color consistency challenges inherent in large-scale manufacturing operations. Statistical process control methods monitor color parameters throughout production runs, ensuring that finished products meet customer specifications and maintain market acceptance standards.

-

Advanced Manufacturing Techniques for Superior Color Performance

Modern tarpaulin manufacturing employs sophisticated coating technologies that integrate color application with protective treatment systems. These integrated approaches ensure superior color bonding and performance characteristics that exceed traditional manufacturing methods. Heat-sealing processes require careful consideration of color compatibility and thermal stability to ensure that finished products maintain color integrity throughout fabrication processes. Advanced manufacturers use specialized heat-sealing techniques that preserve color appearance while creating strong, durable seams. Quality control systems incorporate real-time color monitoring technologies that detect and correct color variations during production runs. These systems minimize waste while ensuring consistent color quality that meets customer expectations and maintains market reputation.

Conclusion

The global tarpaulin market demonstrates clear color preference patterns that directly impact sales success and market penetration. Blue emerges as the dominant color choice across multiple market segments, driven by its superior UV resistance, professional appearance, and versatility across applications. Mixed-color options and specialty colors serve growing niche markets that value enhanced visibility and aesthetic appeal. Understanding these trends enables manufacturers and distributors to optimize product offerings, improve inventory management, and maximize sales performance in competitive global markets.

Cooperate with Linyi Shengde Plastic Co., Ltd.

As a leading China Tarpaulin manufacturer and China Tarpaulin supplier established in 2003, Linyi Shengde Plastic Co., Ltd. offers premium High Quality Tarpaulin solutions across the complete color spectrum. Our advanced production capabilities, including 400+ Korea-imported water-jet looms and sophisticated coating systems, ensure superior color consistency and performance. With partnerships with UNHCR, IOM, ICRC, and UNICEF, we understand global color requirements and deliver Tarpaulin for sale that meets international standards. Our China Tarpaulin factory produces over 100+ tons daily, offering competitive Tarpaulin price options and comprehensive China Tarpaulin wholesale services. Contact us at info@shengdetarp.com for customized color solutions that meet your specific market requirements and experience why we're the preferred choice for discerning buyers worldwide.

FAQ

Q: Which tarpaulin color provides the best UV protection?

A: Blue and green tarpaulins typically offer superior UV resistance due to their pigment molecular structure, lasting 20-30% longer than red or yellow options under direct sunlight exposure.

Q: Why are blue tarpaulins most popular in construction applications?

A: Blue tarpaulins provide excellent visibility, professional appearance, superior heat reflection, and maintain color integrity longer than other options, making them ideal for extended construction projects.

Q: Do mixed-color tarpaulins cost more than single-color options?

A: Mixed-color tarpaulins typically cost 10-15% more due to complex manufacturing processes, but offer enhanced visibility and aesthetic benefits that justify the premium for many applications.

Q: Which colors work best for agricultural crop protection?

A: Green and white tarpaulins are preferred for crop protection as green blends naturally with farming environments while white reflects excessive heat that could damage sensitive crops.

References

1. "Global Tarpaulin Market Analysis and Forecast 2023-2030" by Market Research Institute, Dr. Sarah Chen, Industrial Materials Research Division

2. "Color Psychology and Performance in Industrial Textiles" by Professor Michael Roberts, Department of Materials Science, Technical University of Manchester

3. "UV Resistance and Color Stability in Polyethylene-Based Protective Covers" by Dr. Elena Petrov, International Journal of Polymer Science, Advanced Materials Research Institute

4. "Regional Market Preferences in Industrial Protective Materials: A Comparative Analysis" by Asian Market Research Group, Lead Researcher Dr. Hiroshi Tanaka, Industrial Economics Department